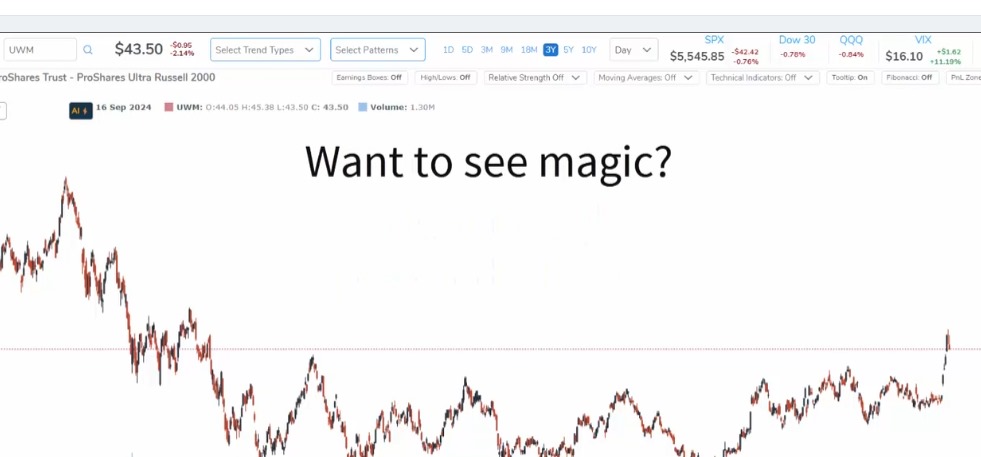

Hot Take Amid the persistent inflation fears and the hysteria often amplified on social media, I remain cautiously optimistic. While I don’t claim to know the future, my stance—that inflation is cooling and the labor market remains resilient—is supported by data and reviews I’ve written over the past year. I’ll lay out my reasoning in …