Lede

Today we got the CPI inflation report.

Kathy Jones pointed out that for the first time since June 2020, the 3-month annualized change for both core and headline CPI are below 2%.

The BLS’ new measure of real-time new rent inflation fell negative.

The New York Fed’s Survey of Consumer Expectations put the three-year inflation outlook at 2.3%, the lowest in a data series going back to June 2013.

Still, no Fed rate cuts.

The unemployment rate is at multi-year highs.

Continuing jobless claims are at multi-year highs.

Credit card delinquencies are at decade highs.

Still, no Fed rate cuts.

As a reminder, CPI is not the inflation report that the Fed target’s for 2%, rather that is PCE inflation.

Here is the data.

- CPI

- MoM: 0.15% vs 0.2% est

- YoY: 2.9% vs 3.0% est

- Lowest since March 2021.

- Six-month annualized 2.5%; lowest since Sep 2020.

- Core CPI

- MoM: 0.168% vs 0.2% est

- YoY: 3.2% vs 3.2% est

- Lowest Since May 2021

- Six-month annualized 2.8%; lowest since March 2021.

When we annualize the Core CPI monthly number, this monthly figure translates to nearly 2% and Ernie Tedeschi notes that core CPI generally runs higher than core PCE, suggesting core PCE would be below 2%.

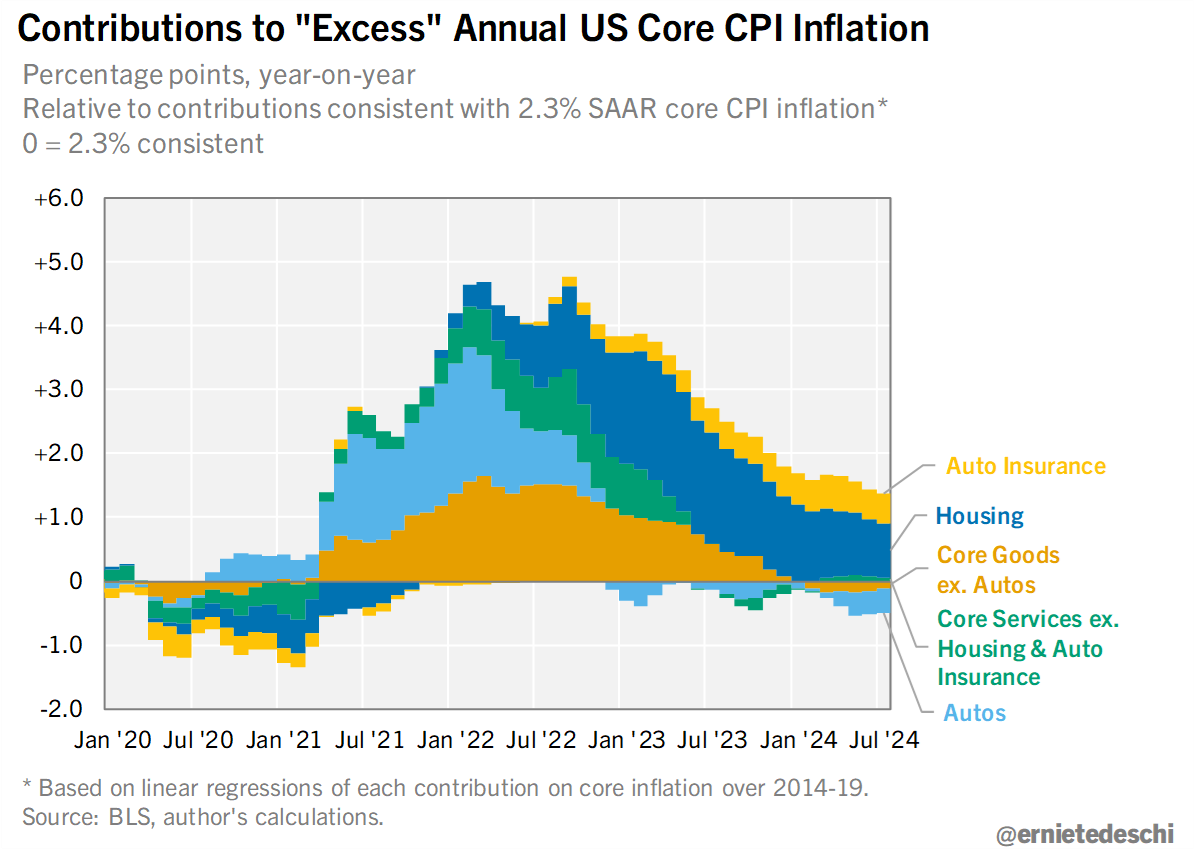

If Core PCE is at 2%, we would expect a Core CPI of 2.3%. The excess is all housing as the rest of the measures cancel each other out.

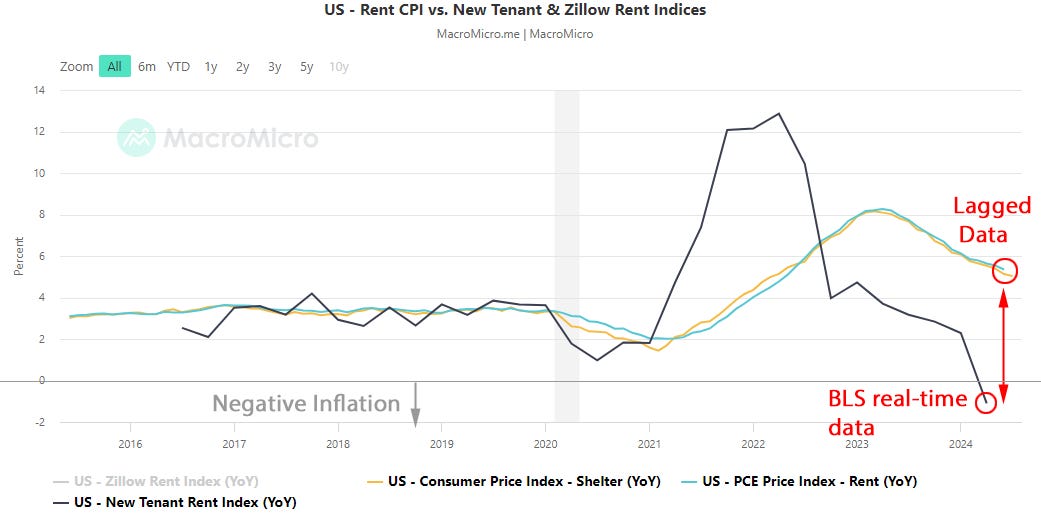

I have written about the deeply flawed and lagged measure of shelter inflation ad nauseum.

Here is a chart:

On a year-over-year basis, core CPI inflation was 3.2%, marking the lowest level since April 2021.

With regard to food inflation, grocery prices increased by 0.13% month-over-month and 1.1% year-over-year; the 18th consecutive month where grocery prices have risen at a slower pace than average hourly earnings

Hourly earnings increased by 0.7%, and weekly earnings went up by 0.4%, both slightly under expectations.

Owners Equivalent Rent (OER) fell again, to 5.3%, but is still a flawed, lagged, and punitive measure of inflation that ultimately could be the reason the Fed waits too long, and pushes the US economy into recession.

Here is a chart:

An unfortunate surprise was that OER rose 0.4% MoM and primary rent rose 0.5% MoM. These are the wrong direction, wrong, and tend to repeat higher.

The owner’s equivalent rent or what you’ll see in the news as OER is simply the estimated rent a homeowner would pay if they were renting their home instead of owning it.

That’s how the BLS got around, excluding homeowners from inflation computations in 1983. Here’s the catch.

Homeowners are only polled once every six months as to the value of rent for their home. And leases, as we all know, occur about once a year.

So there’s an incredible lag in the price of shelter that goes into the computation for inflation, whether that’s CPI or PCE or any other measure.

It’s this lag that creates a difference between reality and what the Federal Reserve is reacting.

The data is so lagged, and the BLS knows this so much, they simply created a new real time new renters index in 2022.

Yep in late 2022, researchers at the BLS and the Cleveland Fed introduced an experimental quarterly index of new tenant rent.

Here is that measure, in the black curve, versus what CPI and PCE read. Note that the real-time measure is now NEGATIVE.

The fact that this lag still drives inflation which otherwise has been at 2% for more than 12-months, is an abomination of logic and could be driver of a recession if the Fed doesn’t stop reacting to the lagged data.

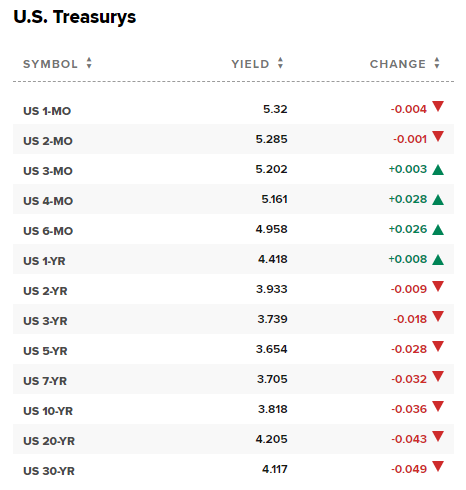

Treasury yields are down in the early trade:

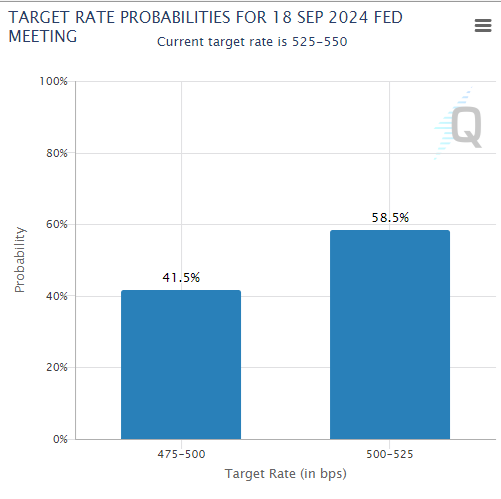

The probability of a rate cut in the September FOMC meeting is now at 100%, with a 41.5% chance of a double (0.50%) rate cut:

Conclusion

What the Fed thinks about inflation and the underlying economic data is the only thing that matters.

I’ll repeat that: What the Fed thinks is the only thing that matters – the data has not mattered.

It’s time to cut rates, and waiting until September takes an unnecessary risk that we will turn to recession given that the unemployment rate has risen to 4.3% from 3.4%.

The unemployment rate is at multi-year highs.

Continuing jobless claims are at multi-year highs.

Credit card delinquencies are at decade highs.

Thanks for reading, friends.

For more reports like this join CML Pro.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.