Lede

I see an elevated risk of recession, but risk of a bad thing doesn’t mean that the bad thing will happen.

I think we are unnecessarily being forced to take this risk by the Fed, but we can still escape.

Let’s do this.

Preface

Yesterday the Federal reserve chose not to cut interest rates.

Tomorrow we will receive the non farm payrolls report (the “Jobs Report”) and with that the unemployment rate (which is at multi-year highs).

So, while I spill some ink below, tomorrow could have everyone reacting with a finger wave saying “no, no, Ophir, you’re wrong. Look at the jobs report.”

My best guess is that non farm payrolls will be boosted by rather outsized government hiring so the “headline” number may look good, but in the details of the report, as it has been for a while, we will see further labor market weakening.

And, to be clear, I hope the jobs report is a knock down, drag out, blow the doors off, amazing report. I want to be wrong.

I do not want to see the United States suffer a recession.

Now…

… Today we received data on weekly jobless claims and continuing jobless claims, as well as wage inflation and the manufacturing sector.

• Continuing jobless broke to another multi-year high.

• Wage inflation broke to another multi-year low.

• Manufacturing Employment PMI broke to a decade low (excluding COVID).

In total, the data supports my view, for now, that the Federal Reserve has been late to cutting rates which have restricted US economic growth and lifted the odds of a recession. The Fed is late. The Fed has been late.

Now we hope.

Story

Here is the data first:

Unit Labor Costs QoQ Prel (labor inflation)

- 0.9% vs 1.8% estimates

- 0.5% over the last four quarters, lowest since Q3 2019.

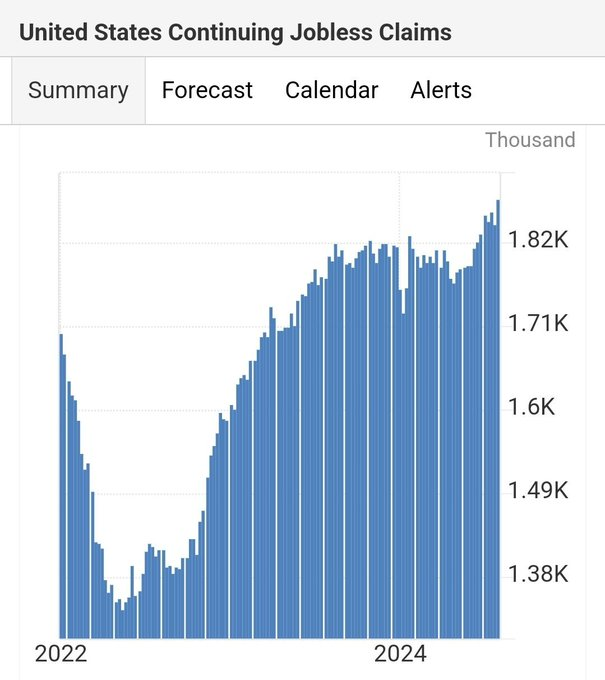

Continuing Jobless Claims

- 1.877M vs 1.86M est; 1.844M prior.

- Multi-year high (image)

— Manufacturing: Below 50 is contraction —

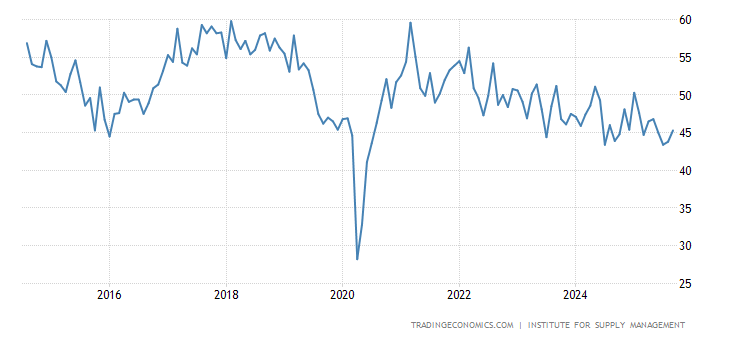

ISM Manufacturing PMI (contraction)

- 46.8 vs 48.8 estimates

ISM Manufacturing Purchasing Managers Index (PMI) 10-Year chart (Source)

Employment (contraction)

- 43.4 vs 49 estimates and 49.3 prior.

US ISM Manufacturing Employment 10-Year chart (Source)

New Orders (contraction)

- 47.4 vs 49.0 estimates and 49.3 prior.

The Fed’s dual mandate is jobs on one hand, and stable prices (inflation) on the other.

With continuing jobless claims at multi-year highs and the unemployment rate at multi-year highs, the jobs portion of the mandate is failing.

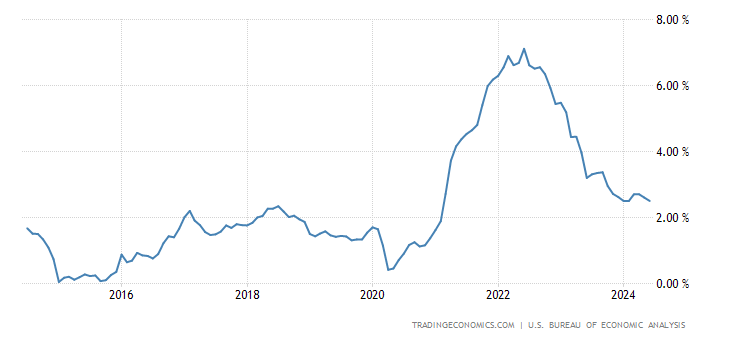

At the same time, inflation, as measured by PCE, is at multi-year lows: 2.5% and falling.

Here is a chart of PCE inflation YoY over the last 10-years:

PCE Price Inflation YoY 10-Year chart (Source)

PCE is, in fact, the measure that the Fed uses to target 2.0% inflation.

Further, we have this:

- Core PCE Excluding Housing YoY:

- • YoY: 2.1%

- Core PCE Market based prices YoY

- YoY: 2.4%

I have written for months now that the Fed needs to cut rates, and my view has gone from an outlier to very much the consensus view.

There is no August FOMC meeting, so unless the Fed moves inter meeting, the US economy is going to have to hold on for two more months.

I offer the possibility that the Jackson Hole meeting in August (22-24) could be an opportunity for the Fed to cut rates before the official September FOMC meeting.

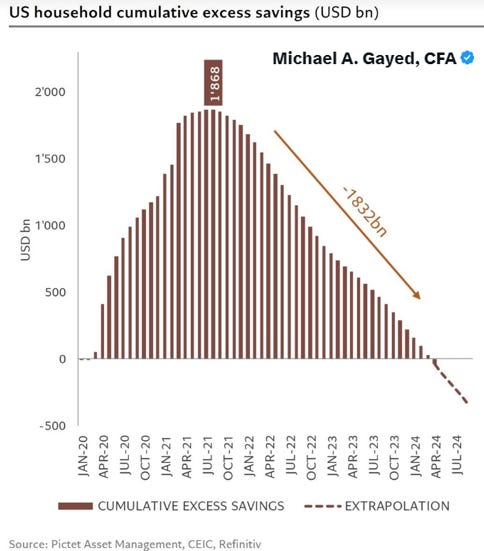

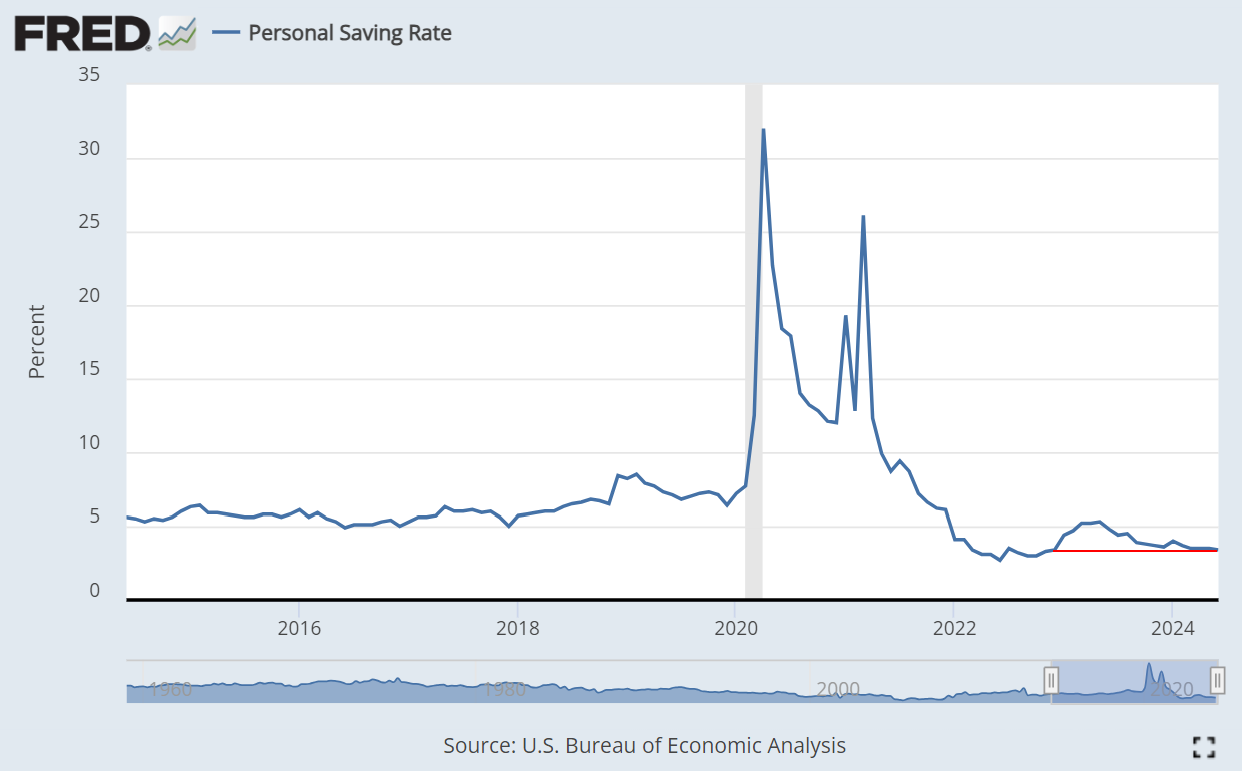

I note that credit card delinquencies are at decade highs (first chart below), and all of the excess savings from the fiscal policy during COVID are gone (second chart), while the savings rate (third chart) is now at a multi-year low:

Credit Card Delinquency Rate

Excess Savings

Savings Rate

So, we have inflation in real time at 2.4% (market based prices) with a target of 2.0% on the one hand, and the highest unemployment rate in several years on the other as credit card delinquencies are at decade highs and excess savings are gone and manufacturing across the board is in contraction.

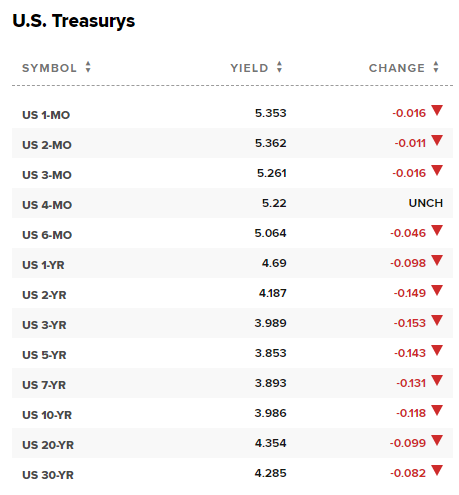

Now we see the market fear of a recession expressed in the yield on the 10-year note:

Treasury (interest) rates are down again:

I have said, ad nauseum, that what the Fed thinks about inflation and the underlying economic data is the only thing that matters.

I’ll repeat that: What the Fed thinks is the only thing that matters – the data has not mattered.

It’s time to cut rates. It has been time to cut rates.

If we don’t get a cut by September at the latest, there should be consideration of an impeachment of Chairman Powell.

Now we hope for a good jobs report and for the US consumer to keep being exceptional and hold on just a little longer.

We had a great GDP number just last week so the hope is still there.

I see an elevated risk of recession, but risk of a bad thing doesn’t mean that the bad thing will happen.

I think we are unnecessarily being forced to take this risk by the Fed, but we can still escape.

Let’s do this.

Now is the perfect time to join CML Pro and prepare for the “After This” winners. Our exclusive stock picks have delivered a 272% return since 2016, far surpassing the NASDAQ, ARKK, and S&P 500.

We have 13 top picks, this email is about 1 of those. 600 institutions have them all.

You can too: Get CML Pro

Thanks for reading, friends.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.