If you trade options long enough, you eventually run into the same bottleneck: most “setups” are noise . You can find a bullish indicator, a bearish indicator, a volatility indicator—often all at the same time—and still not know when the odds are actually tilted in your favor.

OptionSignal™ is built to remove some of that noise. Instead of drowning you in dozens of conflicting charts, it converts a wide range of market inputs into a single, actionable probability‑based output—then ties that signal to a small, diversified set of options strategies designed for different market regimes.

What OptionSignal™ Is (and Why It’s Different)

OptionSignal™ is powered by a Multilayer Perceptron (MLP) neural network with dozens of layers—built specifically to model the market’s non‑linear behavior (where relationships aren’t straight lines and “one indicator” won’t cut it). The model blends many inputs through multiple layers, including real‑time market data tied to volatility, price action, and other instruments.

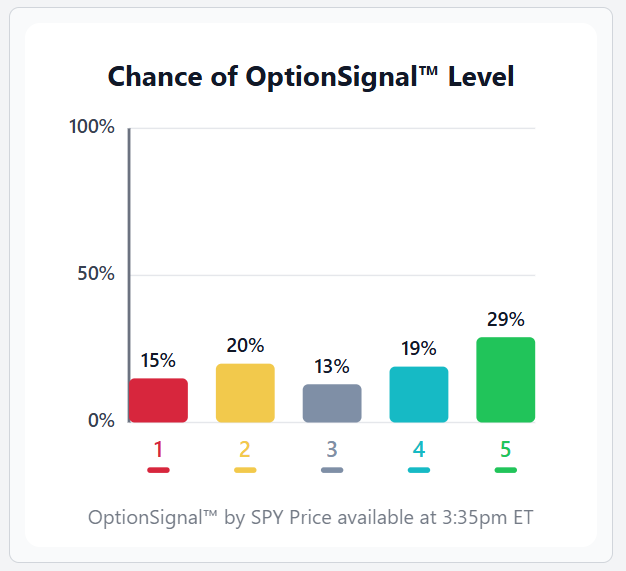

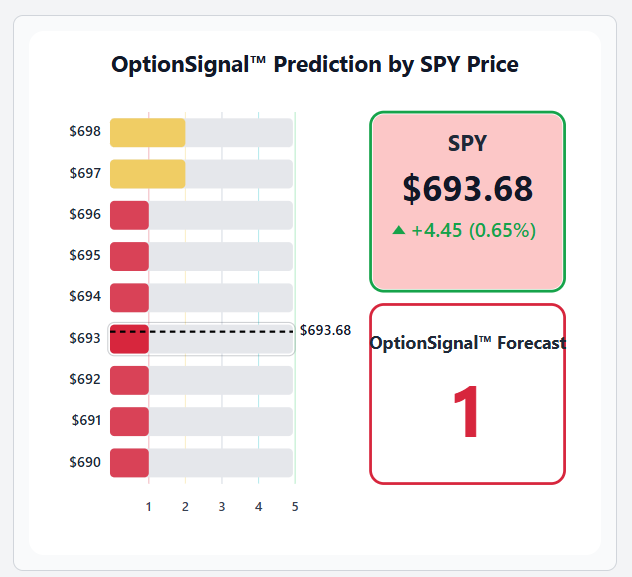

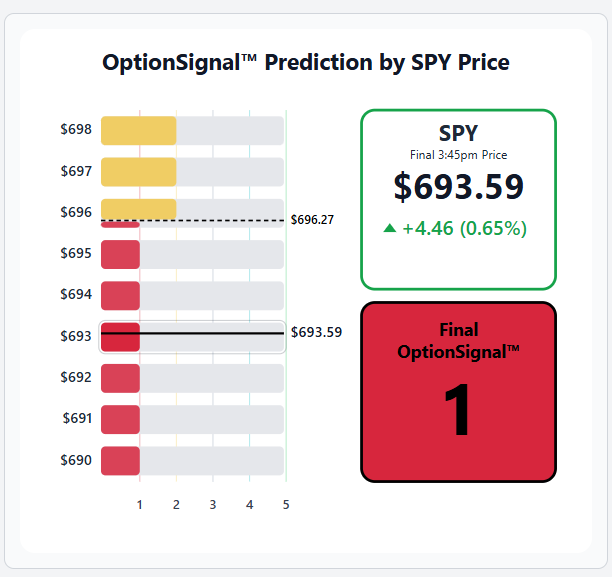

The output is intentionally simple: a 1–5 score

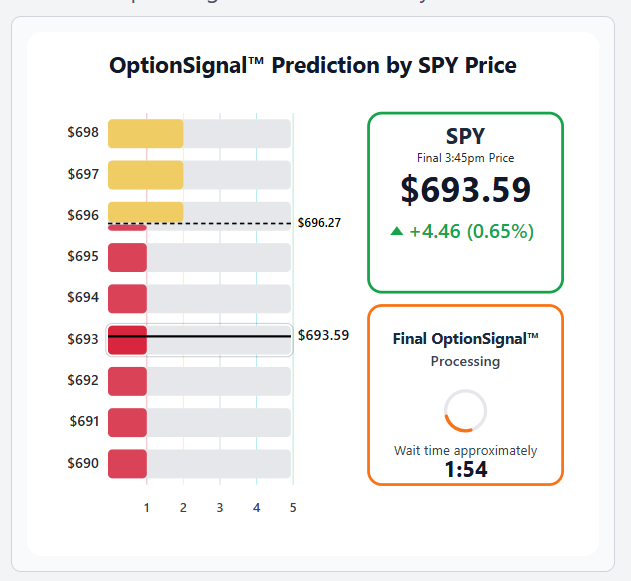

OptionSignal™ generates a whole‑number score from 1 to 5, with the official value published at 3:45pm ET.

1 = Bearish

5 = Bullish

2–4 = low‑information zone (no trigger)

This matters because a lot of “signals” fail in practice for a simple reason: they encourage constant activity. OptionSignal™ is engineered to do the opposite—filter signals down to the moments where probability appears to shift.

That multi‑strategy framework is explicitly emphasized in the OptionSignal™ onboarding and webinar materials: the goal is a repeatable portfolio.

Who Built this?

Ophir Gottlieb is the CEO & Co-founder of Capital Market Laboratories®. He has contributed to The Wall Street Journal, Barron’s, Yahoo! Finance, CNNMoney, MarketWatch, and both Reuters and Factset on their respective professional terminals.

He is a former option market maker on the NYSE ARCA and CBOE exchange floors, and a former hedge fund manager and lead trader for Governance Investors.

He is an analyst of record and contributor through the Thomson First Call / Refinitiv / IBES approved analyst group and terminals as well as a contributor to the Factset consensus and terminals.

He has turned a part of his focus away from institutional finance and re-dedicated his life to helping all people find the capacity and facility to invest with the same confidence and information available to only the top 0.1%.

Current readers of CML Pro research include more than 500 institutions like Morgan Stanley, Goldman Sachs, JP Morgan, Alliance Bernstein, Bank of America, UBS, Tiger Global, Citadel, Citi, Dodge & Cox, Franklin Templeton, and hundreds more. But, in addition, tens of thousands of retail investors also receive the same research at the same time as the institutions.

Ophir Gottlieb is the inventor of the Forensic Alpha Model (FAM) and a co-inventor of Accounting and Governance Risk Model (AGR), both now owned commercially by MSCI. SSRN lists his research, as one of the earliest scientists to identify deep learning, and in particular, neural networks, as a novel approach to examining financial markets while also whole wholeheartedly incorporating corporate governance.

Mr. Gottlieb’s methodological approach taken in creating FAM was endorsed by the head of artificial intelligence for the state of Germany as a novel and extraordinary application of advanced machine learning and quantitative finance.

FAM and AGR are used by asset managers worldwide with over $1 trillion of assets under management. The FAM model has made Mr. Gottlieb one of the most recognized names in all of quantitative finance. Ophir is also the inventor of the ‘Fraud Swap,’ the first and only mathematically verified derivative to swap the risk of fraud out of a stock portfolio. He initiated work on the Fraud Swap while at Stanford University and upon completion was endorsed for that work by Kay Giesecke, a Professor of Management Science & Engineering at the University.

In furthering his analysis and the patent pending derivative, Ophir presented his findings at the 72nd CFA Institute Annual Conference held in London in 2019 covering AI and the Future: Developments, Ethics, and Financial Transformation. A full video of his presentation and the patent pending mathematics and derivative are available here.

The Huffington Post dedicated an article to Ophir’s views in the dossier Financial Services Third Wave of Innovation: AI & Machine Learning. A rare view into his vision of the world of finance, including a 20 minute video session.

Mr. Gottlieb’s mathematics, measure theory, and machine learning background stems from his graduate work in financial mathematics at Stanford University.

Why This Matters: “More Signal” Isn’t the Goal—Better Filtering Is

Most trading tools try to give you more: more scanners, more indicators, more alerts.

OptionSignal™ takes the opposite approach:

-

One score

-

Five strategies

-

Clear triggers

-

Backtested comparisons vs. “No Model” with reported statistical significance

- Check out the webinar to see the results in detail.

OptionSignal™ is:

- Easier – Only one tab

- Faster – Choose from 5 pre-built strategies

- Better – New, incredibly powerful, deep learning AI

That’s the product thesis in plain English:

Identify when markets stop being a coin flip, then deploy the right strategy for that regime.

What It Looks Like in Real Time

Pre-market View:

9:45 – 3:35 pm View

3:35 – 3:45 pm Progressive View

.png)

3:45 pm View

OptionSignal’s rating is official at 3:45pm ET, and SPY/QQQ can offer extended trading hours that provide an extra execution window (an additional ~15 minutes for certain option contracts).

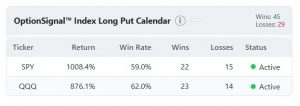

When a final score is a 1 or a 5 the associated strategies will have their status updated to “Active”. By clicking on the associating trigger, you will then be able to see the exact options that TradeMachine® OptionSignal™ would use for the strategy:

What It Looks Like in Real Trades

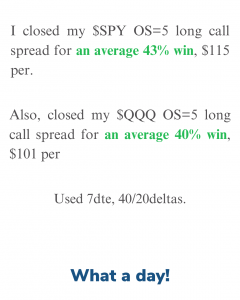

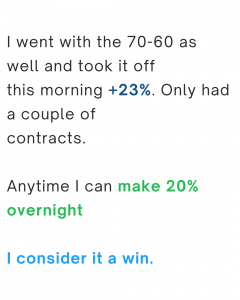

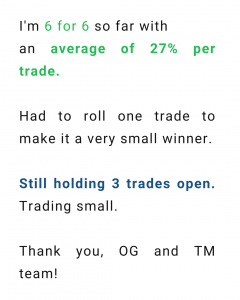

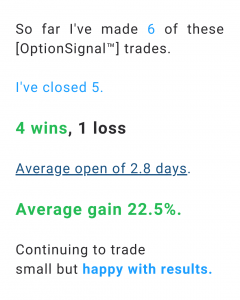

A TradeMachine® and OptionSignal™ user tracked their personal trades and shared them with us:

![]()

-

The trader cycled through SPY and QQQ spreads/diagonals with short holding periods (often just a few days).

-

That’s a 75% win rate in a small sample — but it also shows the reality of options: losers can be larger than winners.

This is exactly why OptionSignal™ is structured as a portfolio of strategies rather than a single “holy grail” trade. It’s also why the strategy specs emphasize profit targets, time exits, and loss constraints — because outcomes are probabilistic, not deterministic.

But what is everyone else experiencing?

Conclusion

At its core, OptionSignal™ is not about predicting markets with certainty—it’s about filtering noise, respecting probability, and acting only when the odds meaningfully shift.

If you’ve ever felt overwhelmed by indicators, alerts, or conflicting signals, OptionSignal™ represents a fundamentally different approach: less activity, better filtering, and a repeatable process built for longevity, not adrenaline.

Ready to Trade With Clearer Signals?

If you want a cleaner, probability-driven way to examine SPY and QQQ options—without drowning in indicators or forcing trades—OptionSignal™ was built for you.

Legal

The information contained here is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained here. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.