6/26/2024

Story

Today I share a short form video summary of my views on inflation and the employment market as we all await the data for May PCE inflation on Friday.

Transcript

Ophir Gottlieb (00:00):

There have been a lot of people asking why I think the Federal Reserve should cut rates when inflation is still high, and I’m going to give you the answer, but the first part is just simply to say the premise of the question is wrong.

Inflation is not high. In fact, it’s not above the Fed’s target, but let’s take our time to get there.

The Federal Reserve has a dual mandate that means it’s responsible for two things, the employment market, so people having jobs and inflation.

The Federal Reserve through monetary policy, which is a fancy way of saying through interest rates, has created a restrictive environment.

That’s a fancy way of saying they’ve made everything slow down in the economy and they did that to lower inflation and it’s worked, but the Fed can break something and we’re already at the inflation target. The first thing you should know is that credit card delinquencies are rising.

(00:45):

Here’s a chart, but that’s not why the Fed should cut rates. The second thing is the savings rate is dropping.

Here’s a chart, but that’s not why the Fed should cut rates. Real disposable personal income year over year growth is slowing, but that’s not why the Fed should cut rates. GDP growth is slowing, but that’s not why the Fed should cut rates.

The unemployment rate is rising. Here’s a chart that’s a part of the reason the Fed should cut rates. That’s the job market, but here’s the real reason.

The Federal Reserve doesn’t have to worry about inflation anymore because it’s already at the target. In fact, I’ll go a step further. If the Fed induced the recession now by keeping monetary policy, fancy word for interest rates too restrictive, fancy word for too high, it would be wholly unacceptable right now and even further, I think it might mean that they should impeach Chairman Powell, the Fed has a 2% inflation target.

(01:38):

Here’s an image. The Fed has been at its target for more than six months. In fact, by my measure for a year, the elements that go into the inflation measures are vast, but one of them is the cost of shelter and it makes up a third of the inflation measure.

Cost of shelter is a fancy way of saying rent. The cost of new homes that is homes that are bought and sold do not go into inflation anymore.

That was taken out in 1983 by the Bureau of Labor Statistics or the BLS. Instead, the BLS took the cost of a home out and invented a new measure called owner’s equivalent Rent. The owner’s equivalent rent or what you’ll see in the news as OER is simply the estimated rent a homeowner would pay if they were renting their home instead of owning it.

That’s how the BLS got around, excluding homeowners from inflation computations. Here’s the catch.

Homeowners are only polled once every six months as to the value of rent for their home. And leases, as we all know, occur about once a year.

So there’s an incredible lag in the price of shelter that goes into the computation for inflation, whether that’s CPI or PCE or any other measure. It’s this lag that creates a difference between reality and what the Federal Reserve is reacting. And if the Federal Reserve keeps reacting to the lagged numbers,

(02:59):

Then we are going to fall into a recession. But let’s take a look at inflation. If we adjust it for real-time shelter, here’s a chart of rent in the inflation measure.

So the numbers that the Federal Reserve is reacting to, that’s in orange and you can see it’s at 5.31% year over year, which is high versus the actual asking rents. That is new leases every month where inflation is 0.2%, so almost zero.

That difference, which is 5.1%, is fully one and a half points of inflation. We would be at the fed’s target. That’s one chart. I have three more.

Let’s go back to that idea of owner’s equivalent rent. And if you’re wondering if any other industrialized nation uses it, the answer is no. The US is the oddball.

So what do other countries do to measure their inflation for shelter? They use market prices.

(03:50):

There is something called a market price inflation index. It has a fancy name. It’s called the harmonized CPI as opposed to just CPI. Harmonized CPI relies solely on actual market prices and not lagged prices.

And if you’re thinking, gosh, does the Fed know about this? Yes, they do.

They produce the data and share it every month. Here’s a chart. Not only has harmonized CPI at 2%, it was at 2% six months ago, 10 months ago and 12 months ago, and it’s about the same level it was in 2019, pre covid, 20 19, 20 18, 20 17, 20 16, and even 2014, we are at 2% inflation. I said there were going to be four charts. That was two.

Here’s chart number three. This is a chart either in the yellow line or the blue line, which shows the level of rent inflation that is used in the inflation indexes. There’s either a CPI or PCE, and you ask yourself, well, what’s that black line?

(04:49):

That black line is something that the Bureau of Labor Statistics, where all of this inflation data comes from, just invented at the end of 2022.

Yep in late 2022, researchers at the BLS and the Cleveland Fed introduced an experimental quarterly index of new tenant rent.

They called it, cleverly, the “new tenant rent index.”

And it uses a very similar method to the Zillow index and the data from CPI housing survey that is in real time. And what do we see yet again, the black line, which is real-time rents, the actual cost of shelter is near zero, whereas inflation measures have it over 5%. So why do I think inflation is already at the 2% target? Well, I’ve shown you three charts.

Finally, here’s a fourth chart. This is, very simply, in orange inflation and in the blue line inflation excluding shelter.

The actual inflation measure is at 2%, and as I said before, has been for a while. In fact, as early as April of 2023, this video is as of June, 2024. So while credit card delinquencies are rising and the saving rate is dropping and real disposable personal income is dropping and GDP growth is

(05:56):

Slowing, the unemployment rate is rising quickly while inflation is already at the fed’s target. There is no excuse for a federal reserve induced recession at this point. It’s time for the Fed to cut rates.

My name is Ophir Gottlieb. I’m a former option market maker on the NYSE ARCA Exchange floor. I’m a former hedge fund manager, a former head of quantitative research for an institution.

I’m a Stanford trained financial mathematician. I have a background in finance, quantitative economic decision systems, and of course math.

Thanks for watching, and I’ll have more videos coming soon that explain the difference between the various inflation indices and which one the Fed actually looks at and why.

Conclusion

Retail investors, the window of opportunity to access CML Pro may be closing soon. Don’t miss out on the chance to join the ranks of elite investors benefiting from our exclusive research, expert stock picks, and in-depth market analysis.

Secure your subscription to CML Pro now, before it becomes available only to professional investors. Click here to get started: https://bit.ly/CMLPro.

Be Proactive with Your Investments! Join the savvy investors who are preparing for the “After This” period with CML Pro. Don’t wait—your path to smarter investments starts today!

For a fuller discussion and to look into long-term stock research please learn more about CML Pro:

CML PRO IS PROUDLY UTILIZED BY 500+ OF THE WORLD’S LARGEST FINANCIAL INSTITUTIONS:

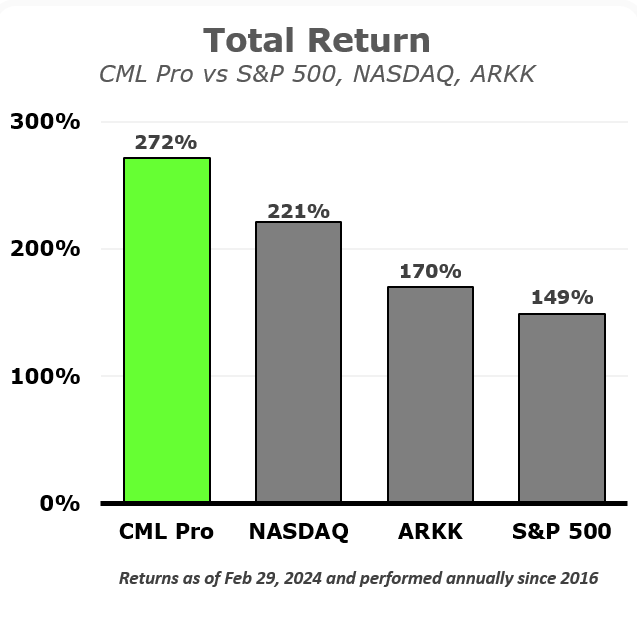

AND HAS DELIVERED SERIOUS RETURNS FOR SERIOUS INVESTORS:

Learn more here and watch a short but instructive video here.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm, or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.