Lede

If you have a proven track record of profitable 0DTE trades, hats off to you, keep doing what you are doing. We believe this is exceptionally rare for retail investors.

If it’s due to a coach, keep that coach.

But if you’re having trouble being consistently profitable trading 0DTE options, it’s not without reason: 0DTE puts you at a structural disadvantage that has persisted for three decades.

Rest assured, you’re not alone, and you’re on the verge of discovering the silver lining within the shadows

There’s another way. Hold that thought…

Preface

Several papers demonstrate the phenomenon that, for over three decades, the entirety of returns in the S&P 500 have been realized through overnight holding periods while intraday holding periods have been negative.

Yes, intraday returns are negative across asset classes and across decades; precisely the time 0DTE options are traded. Did you know that?

The effect can be seen over a wide range of assets, beyond the broad stock market to individual stocks (particularly those popular with retail investors, and Meme stocks most of all), many ETFs, and cryptocurrencies.

This reality may have a significantly negative impact on your success trading 0DTE; and it may also have a significantly positive impact on multi-day option swing trading, in contrast.

There’s good news here. It just comes after the bad news.

The Overnight Drift Phenomenon

We review the findings of three studies that examined the impact of overnight returns in the stock market relative to intraday.

First, a paper entitled “Night Moves: Is the Overnight Drift the Grandmother of All Market Anomalies” comes to the following conclusion:

Over the last three decades, the study finds that all returns on a diverse array of assets, from the broad stock market to individual stocks favored by retail investors like meme stocks, as well as many ETFs and cryptocurrencies, are earned outside of regular trading hours.

During market hours, these assets typically see zero or negative returns.

The effect is seen over a wide range of assets, including the broad stock market, individual stocks (particularly those popular with retail investors, and Meme stocks most of all), many ETFs, and cryptocurrencies.

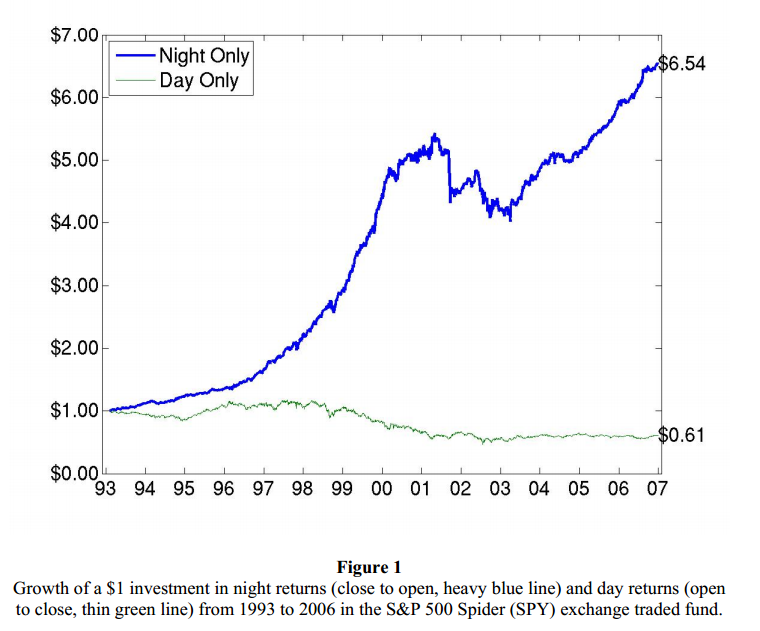

This disparity is depicted in a summary chart:

Note that the dotted blue line is the total return of 1,520%, the green line is the overnight return of 1,750%, and the orange line is the intraday return of negative 13% over 30-years.

Yep, intraday trading, over 30-years was a net losing strategy.

The paper highlights the importance of the research for three reasons, of which we will focus on the first:

First and foremost is that retail traders are potentially missing out on billions of dollars of returns due to mistimed trades.

Second, there is speculation that the overnight effect might have implications for the long-term valuation of the entire equity market.

And finally, assuming our findings and those of others who have studied the effect are correct, this is one of the most consistent, significant and overlooked anomalies in finance, which can contribute to our understanding of the limits of market efficiency.

(Our emphasis added.)

A subsequent analysis on the SPY’s intraday versus overnight returns since 2000 reveals the same stark contrast: intraday returns have been predominantly negative, further emphasizing the critical role of overnight returns in total market performance

Here is a summary chart which goes out to 2021:

A final paper paper dissecting momentum strategy returns found that almost exclusively, overnight periods account for abnormal returns, significantly overshadowing intraday periods.

Here is a summary chart:

In a momentum strategy, intraday returns were -39%, while overnight returns were +554%.

All three papers repeat the same conclusion: the market moves overnight, returns are made overnight, and intraday market moves are, on average, negative.

So why does this matter for 0DTE? And further, why does it matter for multi-day swing trades, in contrast?

Let’s now move the discussion to something called 0DTE.

0DTE

A 0DTE (Zero Days To Expiration) option is a financial derivative that expires on the day it is traded, offering traders the ability to speculate on the underlying asset’s price movements within a single trading day with no exposure to overnight market risks.

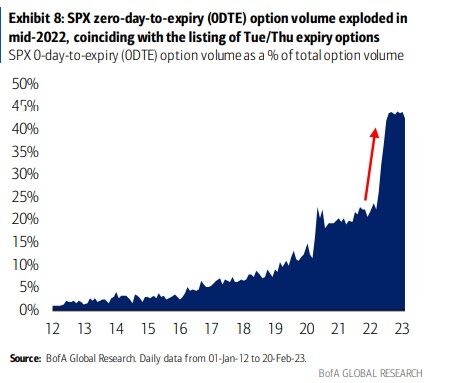

0DTE options’ emergence and rise in popularity, marked by the extension to daily expirations, represent recent market evolutions, with volumes surging post the addition of Tuesday and Thursday expirations.

Initially, options had monthly expirations, but demand for shorter-term options led to the introduction of weekly expirations by Cboe in 2005, followed by Monday and Wednesday expirations in 2016.

The addition of Tuesday and Thursday expirations in 2022 marked a significant turning point, substantially increasing the volume of 0DTE options trading.

From 2016 to 2023, the share of 0DTE trading in SPX options remarkably rose from 5% to over 50%, underscored by a 170% jump in average daily volume, signifying its rapid adoption.

A Bloomberg chart underscores the dramatic uptick in options trading volume from mid-2022, coinciding with expanded 0DTE trading opportunities, thus completing the market’s daily expiration offerings.

According to Cboe, retail traders account for an estimated 30% to 40% of the trading volume in 0DTE contracts. This significant participation of retail traders indicates a shift from the previously professional-dominated market.

Is the opportunity outside of 0DTE for retail traders? We think it is.

These findings collectively underscore a critical insight: though 0DTE volume has erupted higher, much of the stock market’s gains are realized outside of regular trading hours, specifically overnight, and specifically times when 0DTE options are not active.

This challenges the premise of 0DTE options, which are predicated on intraday price movements and do not capitalize on the overnight returns phenomenon.

Given the evidence that intraday returns have been generally negative since 2000, the heightened focus on 0DTE options trading might not be in the best interest of retail traders who miss out on the more substantial, positive overnight returns.

At Capital Market Laboratories, we look for edge. That is patterns that persist through different market cycles, different sectors, and different volatility regimes.

Our CEO, Ophir Gottlieb, has been a pioneer in AI applications in finance.

His findings with regard to neural networks, AI, and excess returns in the stock market were published by the Rotman (University of Toronto) International Journal of Pension Management and presented on the mainstage at the 2019 Annual CFA Institute Conference in a discussion surrounding AI and the Future: Developments, Ethics, and Financial Transformation.

So, what?

Multi-day Overnight Option Swing Trades with AI

While we have not discovered any discernible edge trading 0DTE (yet), we have demonstrated edge in multi-day option trades layering persistent stock patterns with our proprietary AI.

While we preach a healthy dose of PPE – Process (or plan), patience, and effort, we do so in the context of backtesting.

We look for persistent patterns in stock movement layered into a portfolio of option trades which are designed to function in a variety of trade types and markets: long volatility, short volatility, multi-sector, bull markets, bear markets, recovering markets, and falling markets.

Although studies of stock returns over many decades suggest a structural disadvantage in trading 0DTE, we leverage this very phenomenon to uncover advantages in longer-term, spanning several days to weeks, swing trades.

If your 0DTE trading has you down, don’t lose heart. It’s that driving phenomenon that may very well have led you to the beginning of a successful trading experience; you just started on the harder part first.

Your successful experience can begin with TradeMachine.

Legal

The information contained here is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained here. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.

Trading in options involves considerable risk and is not a suitable form of investment for all investors. The risk in options trading that you will lose your entire investment within a relatively short period of time is comparatively high.

Past performance is no guarantee of future results.

Traders should read Characteristics and Risks of Standardized Options.