Lede

As 2023 winds down, now is the time to look toward Q1 2024 and some trade candidates based on historical results and some good news at the end that may make all the difference in the world for you using TradeMachine: live help available every day from a former market maker.

This will be a part of a series of posts; today we will start with identifying a time to examine historically winning option trades when a stock hits oversold conditions: a sort of “buy the dip” strategy with nuance in the software and financial sectors.

The Strategy

There are many ways to define oversold conditions in a stock but perhaps the most common is to look at the RSI (relative strength index).

RSI is a number between 1-100, where a number above 70 is generally considered overbought ad below 30 oversold.

However, in our research, we have found that an RSI below 25 is in fact a stronger signal of oversold conditions (and leading to a short-term rally).

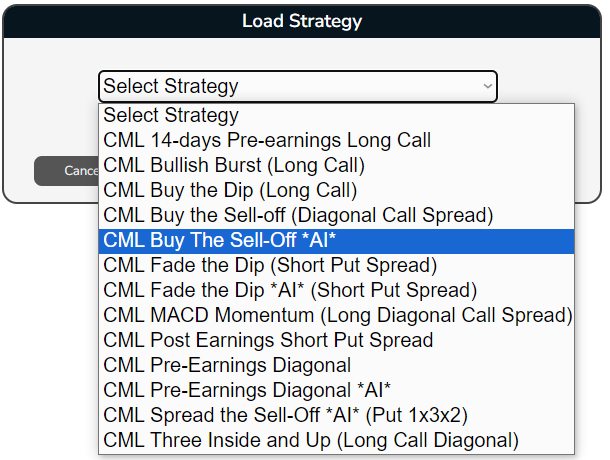

We go inside TradeMachine and select a specific view of this event with the strategy we call “CML Buy the Sell-Off AI.”

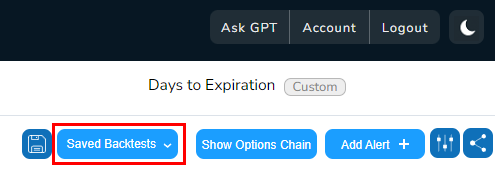

We go to the “Saved Backtests” drop down menu:

And we choose the strategy:

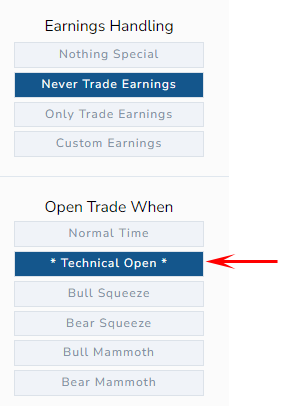

Alright, next we scroll down and see two things:

- This trade always avoids earnings – this is not an earnings speculation irrespective of oversold conditions.

- We can see the specific technical conditions by tapping on the “Technical Open” button.

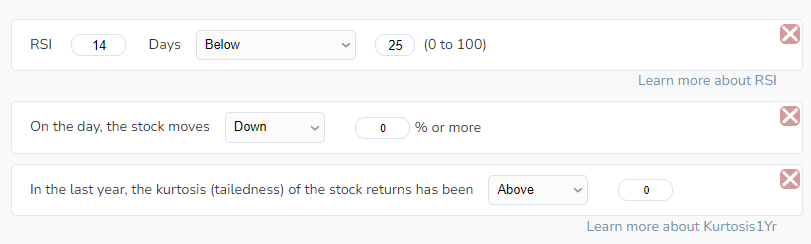

Alright, here are the three technical conditions that must be met for this backtest to trigger:

- First, RSI must be below 25, as we discussed above.

- Second, the stock must be down on the day (any amount).

- Third, our proprietary AI driven method of measuring tail dynamics in the stock must be greater than 0 over the last year.

When all three of those things happen, there’s a trade.

It’s virtually impossible to scan the market for these three coinciding phenomena, so we just set alerts inside TradeMachine so a computer tells us when it happens.

Finally, the actual option strategy we test is this:

This examines getting long an at-the-money (called “50 delta) call option that expires in 60-days and then getting sort an out-of-the-money call option that expires in 30-days.

In option speak, this is called a “diagonal call spread.”

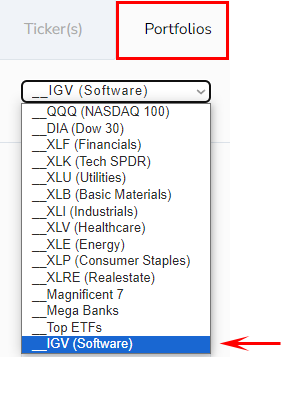

And finally, with that set-up, we can see which software stocks (using the constituents of the IGV ETF) have actually done well when all of these conditions occur:

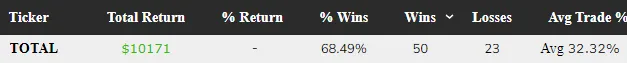

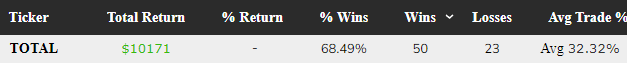

In total, looking over the last 3-years and all 113 stocks, the results in summary have looked like this:

We see a 68% win rate on 73 total trades (50 wins and 23 losses) and an average one-month trade return of 32%. Past performance does not guarantee future results.

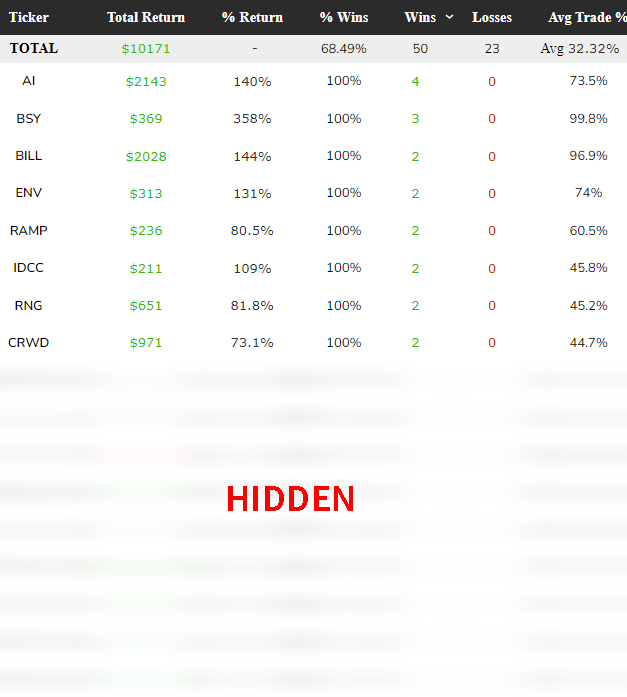

We can then look at specific names. We expose 8 names out of the entire list, and leave the rest to TradeMachine members.

For TradeMachine members, the link to the backtested portfolio is available in a separate email we will send to you.

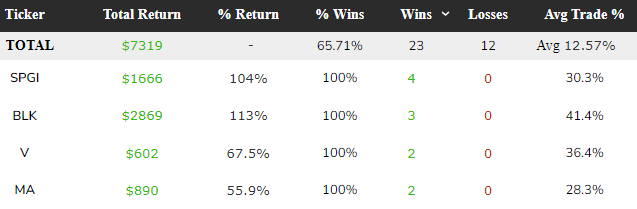

While we’re at it and quite possibly facing a swoon at some point next year in financials, we can also run this against the stocks in the Financial Select Sector SPDR (XLF) ETF.

We share some top performers:

Alright, with the click of a few buttons, TradeMachine’s pre-built strategies and portfolios lead the way.

Add these tickers to alerts and when(ever) the conditions are met, you’ll get an email or a txt message (or both).

And that will do.

We have the start to a portfolio of trades for 2024; this time we looked at oversold conditions where stocks reverse back higher in the Software and Financial sectors.

Now about that thing I promised at the top…

We announced to TradeMachine members in an email “Your Upgrade is Live Help” that, well, yeah, there is now live help in TradeMachine.

The next step in our journey is to give you access to a former market maker and TradeMachine expert, everyday!

We have a former commodity option market maker and long time TradeMachine member that will be available every trading day in Community to answer questions you have about TradeMachine.

Not too shabby.

Leveraging recurrent trends and patterns, like the one above, is what TradeMachine does.

Adding a filter for our proprietary AI measure increases win rates and average returns over both one- and five-year periods.

These results on these strategies span far more than the mega caps.

To gain access to TradeMachine®, with live help, you can go here:

TradeMachine – The Who, What, Why, and How

Thanks for reading and have a fabulous rest of your week and year.

Legal

The information contained here is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained here. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.