Preface

Today we update three triggers that we published in this post:

Three Pre-earnings Triggers; Oil and Tech; Two Flavors from July 19th.

Results

That post discussed three triggers for the day, all of the pre-earnings momentum type:

- CVS pre-earnings diagonal call spread

- MRO pre-earnings diagonal call spread

- FROG pre-earnings long call

All three backtests are still open, and look like this as of yesterday’s close:

Backtest link

The CVS diagonal spread is up 21% in four days and did so as the stock did this (below), where the green arrow is from TradeMachine signaling the opening of the backtest:

A long stock position, for those that aren’t option trading and prefer to use Pattern Finder instead, also would have done quite well.

Next we turn to MRO.

Backtest link

The MRO diagonal spread is up 27.9% in four days and did so as the stock did this, where the green arrow is from TradeMachine signaling the opening of the backtest:

Again, a long stock position, for those that aren’t option trading and prefer to use Pattern Finder instead, would have done quite well.

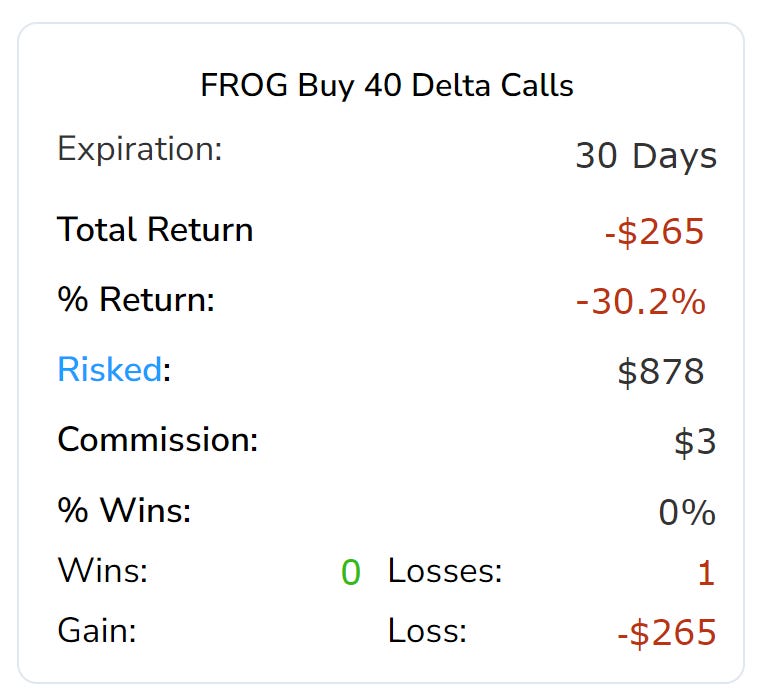

And finally we turn to FROG.

Backtest link

The FROG long call backtest is still open but is down 30% as of yesterday, though the stock is higher today.

It did so as the stock did this, where the green arrow is from TradeMachine signaling the opening of the backtest:

We can see the dark candle from today in real-time, though the PnL marks above use end of day pricing.

We will not be doing a daily recap of backtests because we will not be sharing many active backtests free non members and we are not a trading service, but this is a good start for those who are curious and want to learn more about the discovery.

Conclusion

A sample of three backtests is not enough to conclude much at all, but with the tens of thousands of backtests we ran as we introduced the power of our new (proprietary) skew and kurtosis algorithms, this is about right.

As of now, two winning trades, one losing backtest, all about the same size in gain (or loss), and a net of a winning portfolio of trades.

What we have uncovered is an anomaly.

This is a serious finding and it has resulted in superior returns and higher win rates over several backtesting windows (5-years, 3-years, 6-months) and over tens of thousands of individual backtests on several differing strategies, from long equity, to call spreads, short put spreads, and more.

The results are so much improved from traditional options trading, that you simply can’t ignore it.

Learn more about TradeMachine.

Alternatively, if options aren’t your thing but stocks are, Pattern Finder is your tool and there is a five-minute video discussing these same dynamics but only in stocks.

Thanks for reading, and please note the disclaimers below, namely that this is not to be construed as advice, not a solicitation to buy or sell any security ever, and not a replacement for a professional financial advisor.

Thanks for reading, friends.

Legal

The information contained on this site is provided for general informational purposes, as a convenience to the readers. The materials are not a substitute for obtaining professional advice from a qualified person, firm or corporation. Consult the appropriate professional advisor for more complete and current information. Capital Market Laboratories (“The Company”) does not engage in rendering any legal or professional services by placing these general informational materials on this website.

The Company specifically disclaims any liability, whether based in contract, tort, strict liability or otherwise, for any direct, indirect, incidental, consequential, or special damages arising out of or in any way connected with access to or use of the site, even if I have been advised of the possibility of such damages, including liability in connection with mistakes or omissions in, or delays in transmission of, information to or from the user, interruptions in telecommunications connections to the site or viruses.

The Company makes no representations or warranties about the accuracy or completeness of the information contained on this website. Any links provided to other server sites are offered as a matter of convenience and in no way are meant to imply that The Company endorses, sponsors, promotes or is affiliated with the owners of or participants in those sites, or endorse any information contained on those sites, unless expressly stated.